Crypto Today: Bitcoin, Ethereum, XRP bullish structure holds amid steady institutional interest

- Bitcoin consolidates above $107,000, with the uptrend bolstered by steady inflows into spot ETFs.

- Metaplanet purchases 1,005 BTC, bringing the company's total holdings to 13,350 BTC.

- Ethereum struggles to maintain gains following last week's recovery, while XRP extends its pullback, aiming for $2.10 support.

Cryptocurrency prices are taking a breather on Monday following a recovery staged last week, with Bitcoin (BTC) breaking above multiple hurdles, including $107,000 and $108,000. The bullish momentum can be attributed to a growing risk appetite, particularly among institutional investors and companies that are creating or expanding their digital asset treasuries.

Interest in top altcoins, including Ethereum (ETH) and Ripple (XRP), remains elevated, with inflows into digital asset investments totaling $17.8 billion in the first half of the year, according to CoinShares' weekly report.

Looking ahead: Key events likely to shape crypto trading this week

As Bitcoin leads the recovery in the cryptocurrency market, traders may want to pay attention to key events that could shape sentiment this week, including the United States (US) Federal Reserve Chair Jerome Powell's speech on Tuesday at the ECB Forum in Sintra (Portugal), followed by the Job Openings and Labor Turnover Survey (JOLTS) on the same day.

The Ethereum community conference will take place from Monday to Thursday, while the US ADP Nonfarm Employment Change report is expected on Wednesday.

Two crypto Index Exchange Traded Funds (ETFs) proposals by Hashdex and Bitwise have their deadlines on Wednesday, with the Securities and Exchange Commission (SEC) expected to release its decision.

On Thursday, traders can anticipate the release of the US Nonfarm Payrolls (NFP) and jobless claims reports. US markets will be closed on Friday, July 4, as the country marks Independence Day.

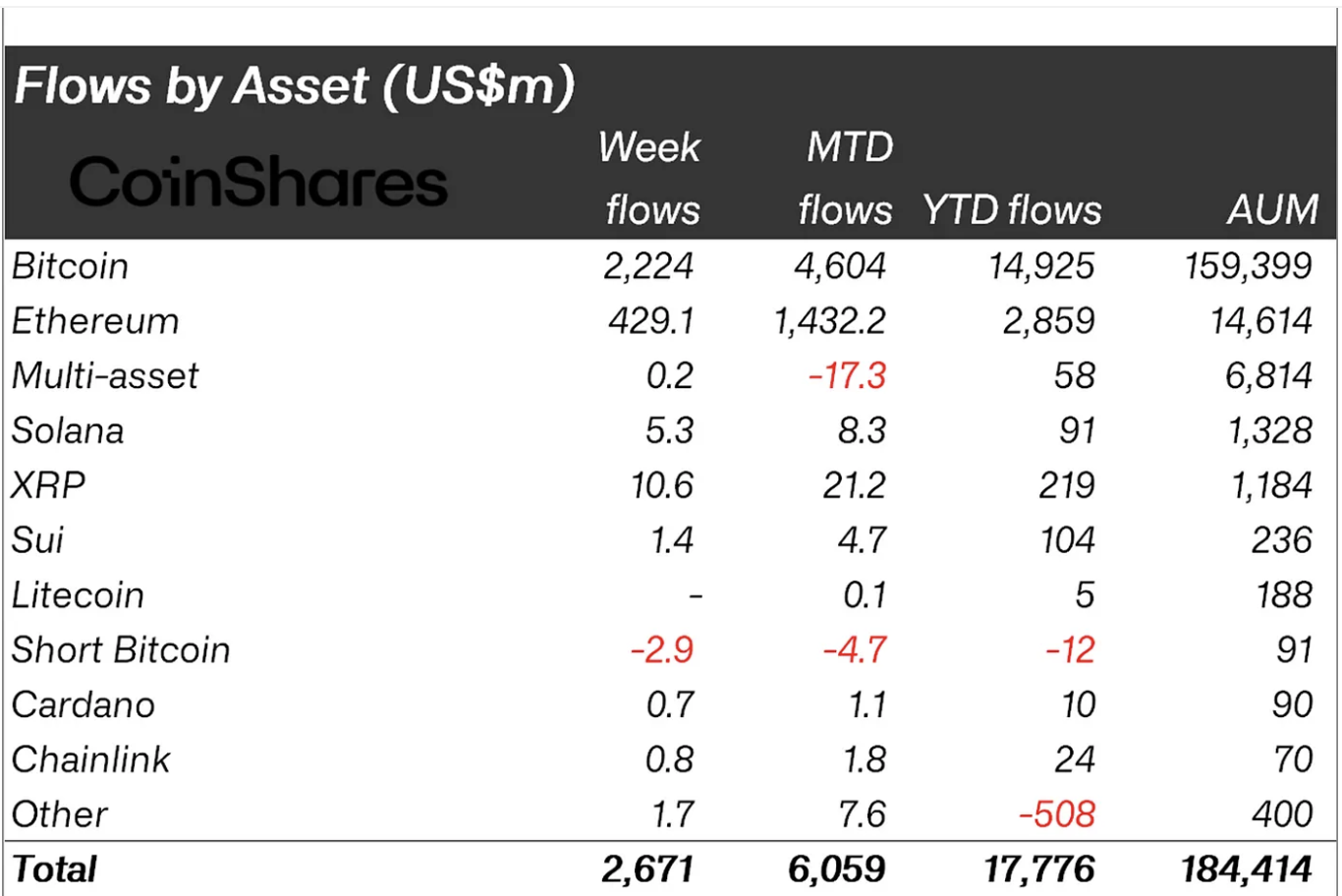

Data spotlight: Digital asset fund flows hit $17.8 billion YTD

Interest in digital asset investment products has maintained a bullish outlook since the start of the year, reaching $17.8 billion, according to the CoinShares weekly report released every Monday.

Digital asset investment products flow data | Source: CoinShares

Inflows into digital financial products, including spot ETFs, totaled $2.7 billion last week. This marked the 11th consecutive week of inflows, with the US contributing the lion's share at $2.65 billion.

"Bitcoin led with 83% of inflows (US$2.2bn), while Ethereum saw US$429m; short-Bitcoin products continued to see outflows, signalling positive market sentiment," CoinShares weekly report said.

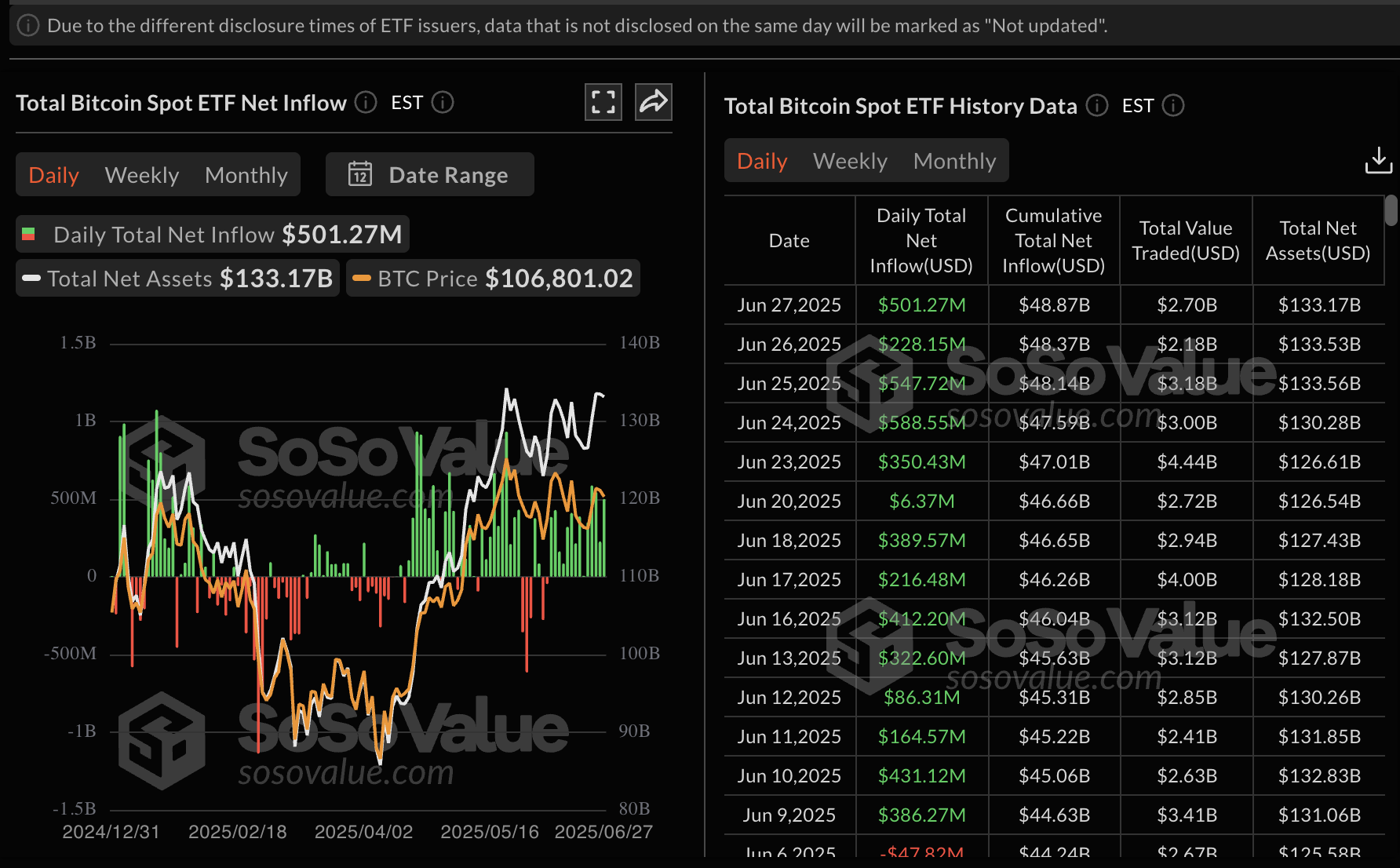

Inflows into Bitcoin spot ETFs totaled approximately $501 million, upholding a 14-day bullish streak.

Bitcoin spot ETF data | Source| SoSoValue

Interest in Ethereum-related financial products also remains high, with CoinShares reporting approximately $429 million in inflows last week. Ethereum spot ETFs recorded a net inflow of around $77.5 million on Friday, bringing the cumulative total to $4.18 billion, according to SoSoValue data.

Ethereum spot ETF data | Source| SoSoValue

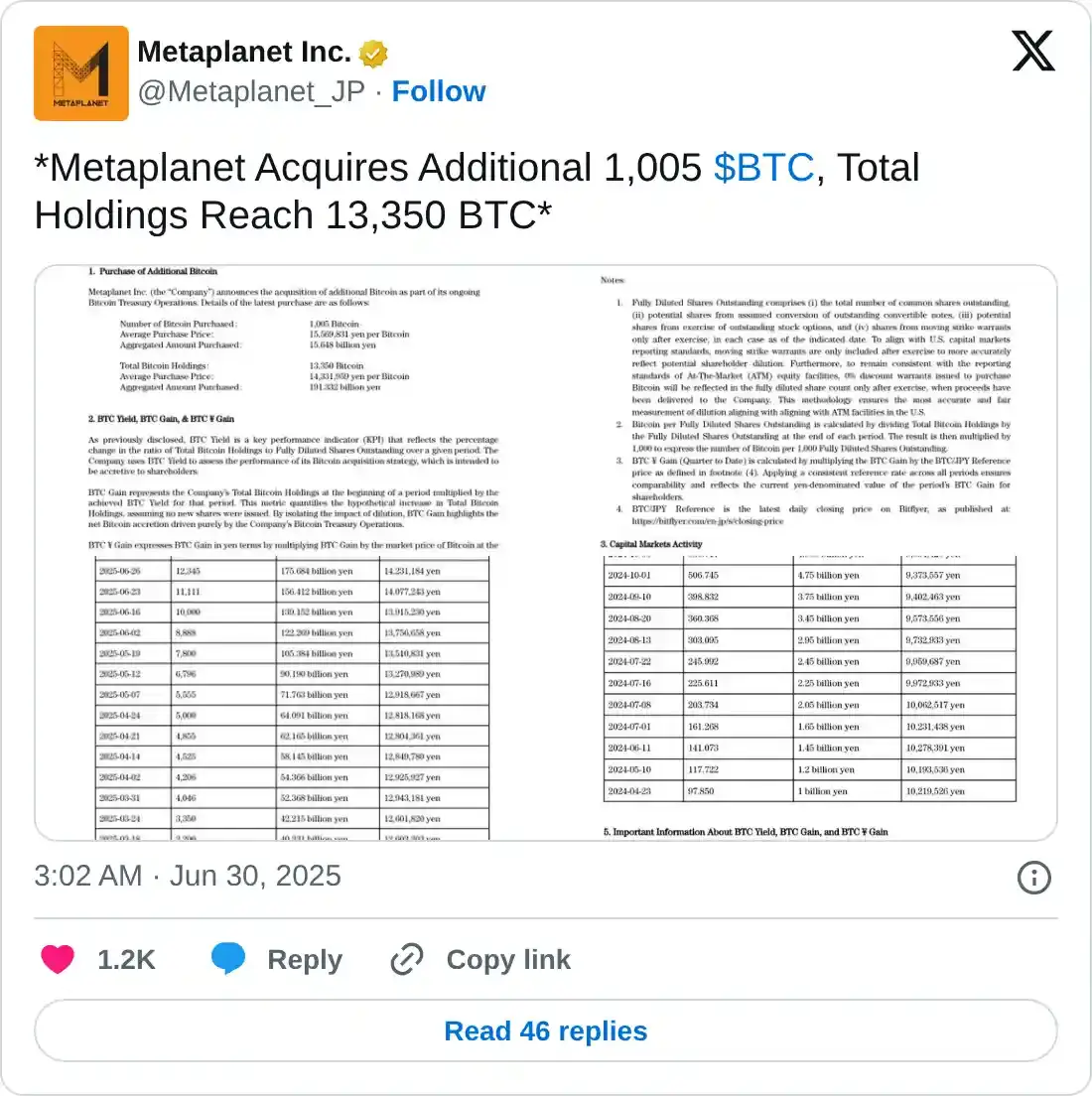

Meanwhile, Metaplanet Inc. (TYO) announced the purchase of an additional 1,005 BTC at an average price of around $107,923. In total, Metaplanet spent roughly $108 million to bring its total Bitcoin holdings to 13,350. This is part of the company board's decision to execute a "Bitcoin-accumulation strategy." Metaplanet is currently the second-largest corporate holder of Bitcoin, behind Strategy, which holds 592,345 BTC.

Chart of the day: Bitcoin's uptrend stalls

Bitcoin retreats on Monday after three consecutive days of gains. The uptick during the weekend peaked at around $108,818 before pulling back to trade at $107,467 at the time of writing.

The daily chart below shows a sell signal flashed by the SuperTrend indicator on June 22. This signal, which serves as a dynamic resistance, suggests that the down leg may extend into upcoming sessions. Bitcoin could remain upside-heavy until a buy signal occurs, marked by the price flipping above the SuperTrendline, changing its color from red to green.

BTC/USD daily chart

Key levels likely to shape Bitcoin's technical structure this week include the immediate support at $106,600, which was tested on Friday, and the 50-day Exponential Moving Average (EMA), currently at $104,120.

On the upside, recovery above $109,000 could help steady the uptrend and consequently increase the probability of the BTC price breaking above the $110,000 round-figure psychological barrier.

Altcoins update: Ethereum, XRP uptrend falters

Ethereum is trading at around $2,450 after facing rejection from the resistance level tested on Monday at $2,522. The smart contracts token is currently holding below the 200-day EMA, which would serve as resistance at $2,468 in the event of a continuation of the uptrend.

The Relative Strength Index (RSI) has slipped slightly below the midline. If the decline persists, traders may want to prepare for tentative support at $2,427, as highlighted by the 50-day EMA on the daily chart below. Other Key levels to keep in mind are the 100-day EMA at $2,378 and the level tested as support at $2,110 on June 22.

ETH/USDT daily chart

As for XRP, Ripple's token is extending the intraday decline to trade at $2.17, down nearly 1.5%. The recovery staged last week lost steam below the 100-day EMA resistance at $2.22. Losses could extend in upcoming sessions, especially with the RSI sliding below the midline.

XRP/USDT daily chart

Should the pullback hold, the price of XRP could sweep through liquidity at the $2.10 support, marked by the 200-day EMA and highlighted at $1.90, which was tested on June 22 after the US struck Iranian nuclear sites.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.