Bitcoin Weekly Forecast: Inches away from all-time highs

- Bitcoin price recovers nearly 7% so far this week, remaining just inches away from its record levels.

- Global risk appetite is increasing as the ceasefire between Iran and Israel, along with the Fed's softer stance on crypto-related banking, takes hold.

- BTC demand remained robust as corporate accumulation rose and spot ETFs recorded a total of $1.49 billion until Thursday.

Bitcoin (BTC) price has risen nearly 7% so far this week and is currently trading above $107,000 at the time of writing on Friday, just inches away from its all-time high. The rebound comes as global risk sentiment improves following a ceasefire between Iran and Israel and as the US Federal Reserve (Fed) announced a softer stance on crypto-related banking at the start of the week.

Apart from this risk-on sentiment, corporate accumulation and institutional demand remained strong throughout the week, suggesting that BTC could rally towards its record highs.

Iran-Israel ceasefire fuels risk appetite

Bitcoin price started the week on a positive note, recovering from its Sunday low of $98,200 to gain 4.33% and close above $105,000 on Monday. This sharp price rise came in as the news emerged that US President Donald Trump had announced a “complete and total” ceasefire between Israel and Iran, effectively pausing the ongoing 12-day war.

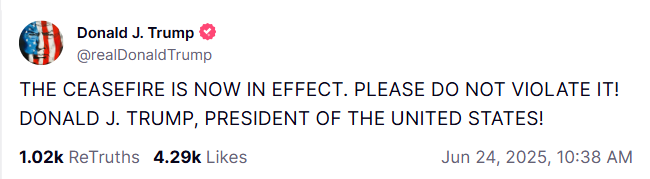

Later on Tuesday, Donald Trump’s Truth Social account posted that “THE CEASEFIRE IS NOW IN EFFECT,” and called on both nations not to violate it, fueling the risk-on sentiment in the global markets, with BTC closing above $107,000 on Wednesday and stabilizing around this level when writing on Friday.

Corporate and institutional demand strengthens

Bitcoin price has been supported by rising corporate and institutional demand this week. BTC has seen a series of accumulations from public companies, adding a total of 7,597 BTC this week. Strategy, Metaplanet, and the Blockchain Group added a total of 1,431 BTC on Monday. This accumulation trend continued the next day with Anthony Pompliano’s ProCap BTC, LLC purchasing 3,724 Bitcoins within one day after announcing a $1 billion merger and an over $750 million fundraising on Monday. The firm also added 1,208 BTC on Wednesday, bringing its total holding to 4,932 BTC.

Lastly, on Thursday, Metaplanet added another 1,234 BTC, bringing the firm's total holding to 12,345 BTC.

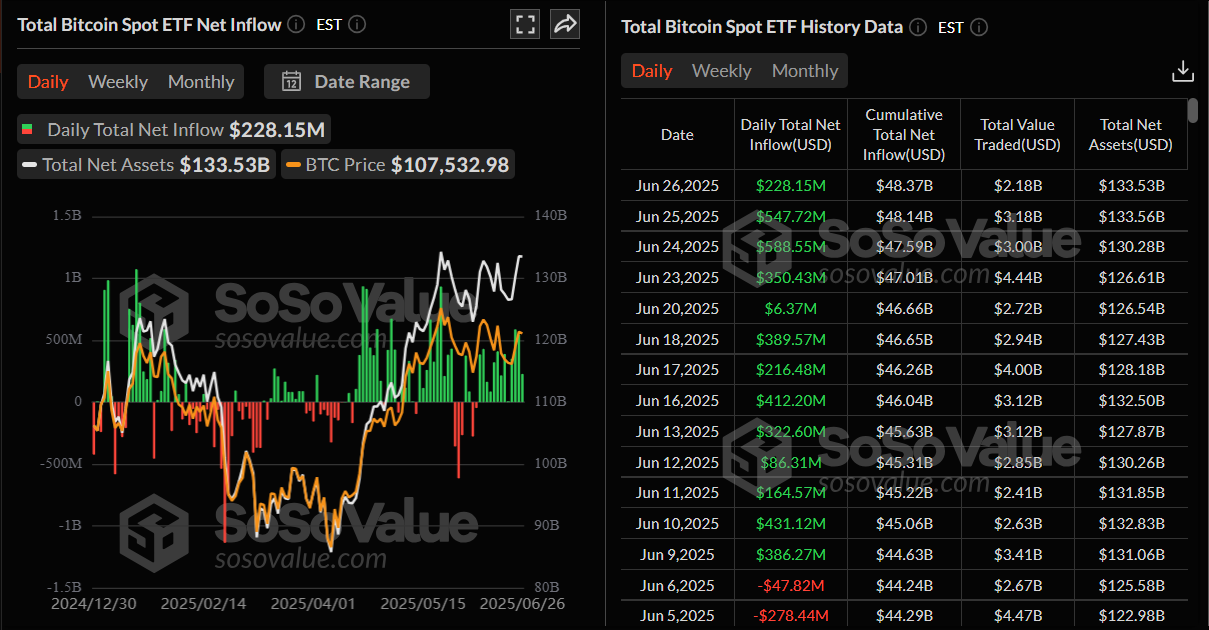

Looking at the spot Bitcoin Exchange Traded Funds (ETFs) demand, it continued its 13-day streak of inflows since June 9.

Total Bitcoin spot ETF net inflow daily chart. Source: SoSoValue

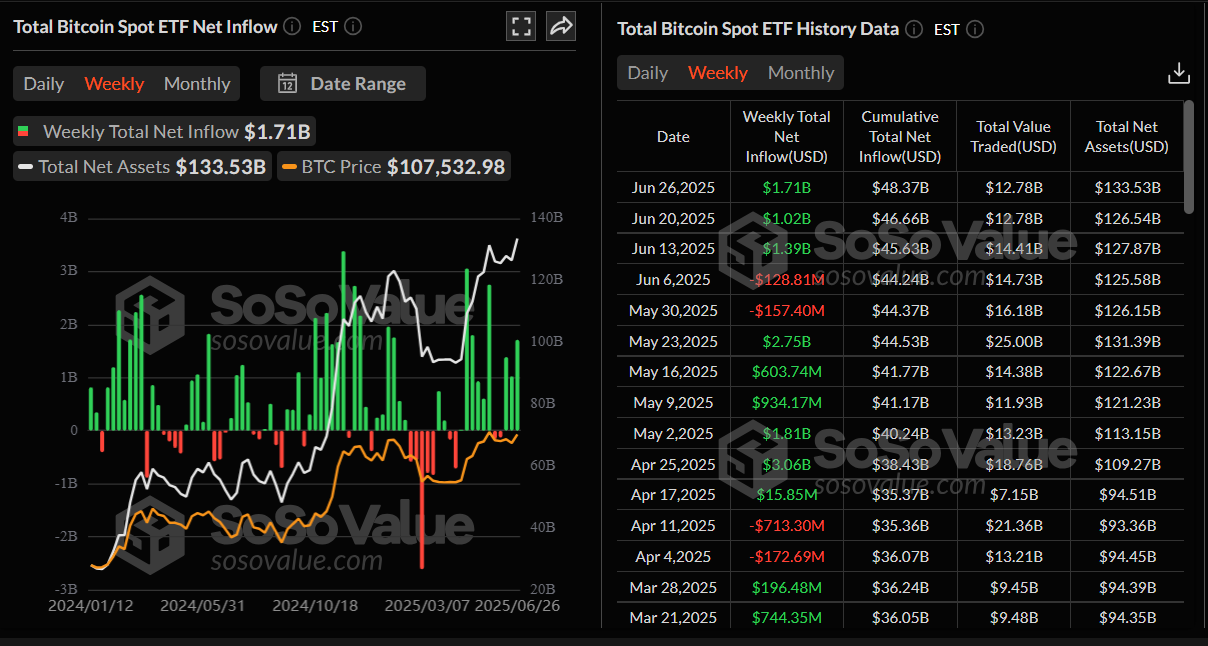

As shown in the SoSoValue weekly chart below, the ETF recorded a total of $1.71 billion in inflows as of Thursday, continuing its three-week streak of positive flows. Moreover, this week's inflows were the highest weekly flow since the end of May, when BTC reached its new all-time high (ATH) at $111,980. If the inflow continues and intensifies, BTC could reach or even surpass its ATH.

Total Bitcoin spot ETF net inflow weekly chart. Source: SoSoValue

Supporting regulatory policies boosts BTC price

The US Federal Reserve Board announced on Monday that “reputational risk” will no longer be a component of its examination programs in supervising banks.

This news added fuel to the ongoing recovery of Bitcoin, as the “reputational risk,” also commonly known as Operation Choke Point 2.0, had previously prevented banks from providing custody services for crypto assets and financial services to digital asset companies.

This policy shift and the Fed's more lenient stance on crypto-related banking could boost the wider adoption and acceptance of digital assets. However, the Fed still expects banks to maintain robust risk management to ensure safety and soundness, as well as compliance with laws and regulations.

Senator Cynthia Lummis said on her X account on Monday, “This is a win, but there is still more work to be done.”

Apart from this, supporting regulatory policies, later on Wednesday, William Pulte, Director of the Federal Housing Finance Agency (FHFA), announced on his official X account that he has directed Fannie Mae and Freddie Mac to prepare their businesses to recognize cryptocurrency as an asset for mortgage purposes.

Pulte said, “After significant studying, and in keeping with President Trump’s vision to make the United States the crypto capital of the world, today I ordered the Great Fannie Mae and Freddie Mac to prepare their businesses to count cryptocurrency as an asset for a mortgage.”

This announcement could reshape mortgage markets, potentially increasing access to homeownership for crypto holders.

However, investors should keep a watchful eye on FHFA’s proposal details, regulatory clarity and market reaction in the upcoming days.

Macroeconomics development

Gains in crypto markets were also supported by improved risk appetite and rising expectations of a dovish Federal Reserve, which pushed the 2-year Treasury yield further below the 4% mark during the first half of this week.

Later in the week, Fed Chair Jerome Powell took a cautious stance when testifying before US Congress on Tuesday and Wednesday, adopting a wait-and-see approach to interest rate decisions. This approach by Powell was criticized by US President Donald Trump, who has been vocal about wanting lower rates. The Wall Street Journal reported that the President has toyed with the idea of selecting and announcing Powell’s replacement by September or October, according to people familiar with the matter.

The President on Wednesday hinted that he’s ready to move more quickly. “I know within three or four people who all I’m going to pick,” Trump said during a press conference at the NATO summit. “He goes out pretty soon, fortunately, because I think he’s terrible.”

The possibility of political interference in the Fed’s decisions has raised concerns about its independence. It could weigh on the US Dollar (USD), potentially boosting demand for riskier assets, such as Bitcoin.

Regarding US economic data, the United States' Gross Domestic Product (GDP) contracted at an annual rate of 0.5% in the first quarter, the US Bureau of Economic Analysis (BEA) announced on Thursday. This reading came in worse than the previous estimate and the market expectation of -0.2%.

Meanwhile, the US weekly Initial Jobless Claims fell by 10K to a seasonally adjusted 236K during the week ended June 21. However, Continuing Jobless Claims increased by 37K to reach 1.974 million, or the highest since November 2021, for the week ending June 14. This overshadowed the largest increase in Durable Goods Orders since July 2014 and kept the USD depressed near its lowest level since March 2022.

Investors now look forward to the release of the US Personal Consumption Expenditures (PCE) Price Index on Friday– the Fed's preferred inflation gauge. The key data will be looked at for cues about the Fed's rate-cut path, which, in turn, will play a key role in influencing the near-term USD price dynamics, providing some meaningful impetus to riskier assets, such as Bitcoin.

Will BTC set a new all-time high?

Bitcoin price declined, reaching a daily low of $98,200 on Sunday, but avoided a daily close below the $100,000 psychological level. BTC recovered sharply on Monday and continued its recovery over the next two days, closing above $107,000 on Wednesday and stabilizing the next day. At the time of writing on Friday, it hovers around $107,300.

If BTC continues its ongoing rally, it could extend toward the May 22 all-time high at $111,980. A successful close above this level could extend additional gains to set a new all-time high at $120,000.

The Relative Strength Index (RSI) on the daily chart reads 56, above its neutral level of 50, indicating bullish momentum. The Moving Average Convergence Divergence (MACD) indicator also displayed a bullish crossover on Thursday, providing a buy signal and indicating an upward trend.

BTC/USDT daily chart

However, if BTC faces a correction, it could extend the decline to find support around the 50-day Exponential Moving Average (EMA) at $103,675.

Crypto ETF FAQs

An Exchange-Traded Fund (ETF) is an investment vehicle or an index that tracks the price of an underlying asset. ETFs can not only track a single asset, but a group of assets and sectors. For example, a Bitcoin ETF tracks Bitcoin’s price. ETF is a tool used by investors to gain exposure to a certain asset.

Yes. The first Bitcoin futures ETF in the US was approved by the US Securities & Exchange Commission in October 2021. A total of seven Bitcoin futures ETFs have been approved, with more than 20 still waiting for the regulator’s permission. The SEC says that the cryptocurrency industry is new and subject to manipulation, which is why it has been delaying crypto-related futures ETFs for the last few years.

Yes. The SEC approved in January 2024 the listing and trading of several Bitcoin spot Exchange-Traded Funds, opening the door to institutional capital and mainstream investors to trade the main crypto currency. The decision was hailed by the industry as a game changer.

The main advantage of crypto ETFs is the possibility of gaining exposure to a cryptocurrency without ownership, reducing the risk and cost of holding the asset. Other pros are a lower learning curve and higher security for investors since ETFs take charge of securing the underlying asset holdings. As for the main drawbacks, the main one is that as an investor you can’t have direct ownership of the asset, or, as they say in crypto, “not your keys, not your coins.” Other disadvantages are higher costs associated with holding crypto since ETFs charge fees for active management. Finally, even though investing in ETFs reduces the risk of holding an asset, price swings in the underlying cryptocurrency are likely to be reflected in the investment vehicle too.