Ethereum Price Forecast: ETH dives 7%, increase in loss realization could spark intense selloff

Ethereum price today: $3,170

- Ethereum investors have booked over $500 million in profits and $100 million in losses since Sunday.

- Increased loss taking has historically sparked heavy distribution and price declines.

- ETH risks a decline to the $2,850 key level if it loses the $3,100 support.

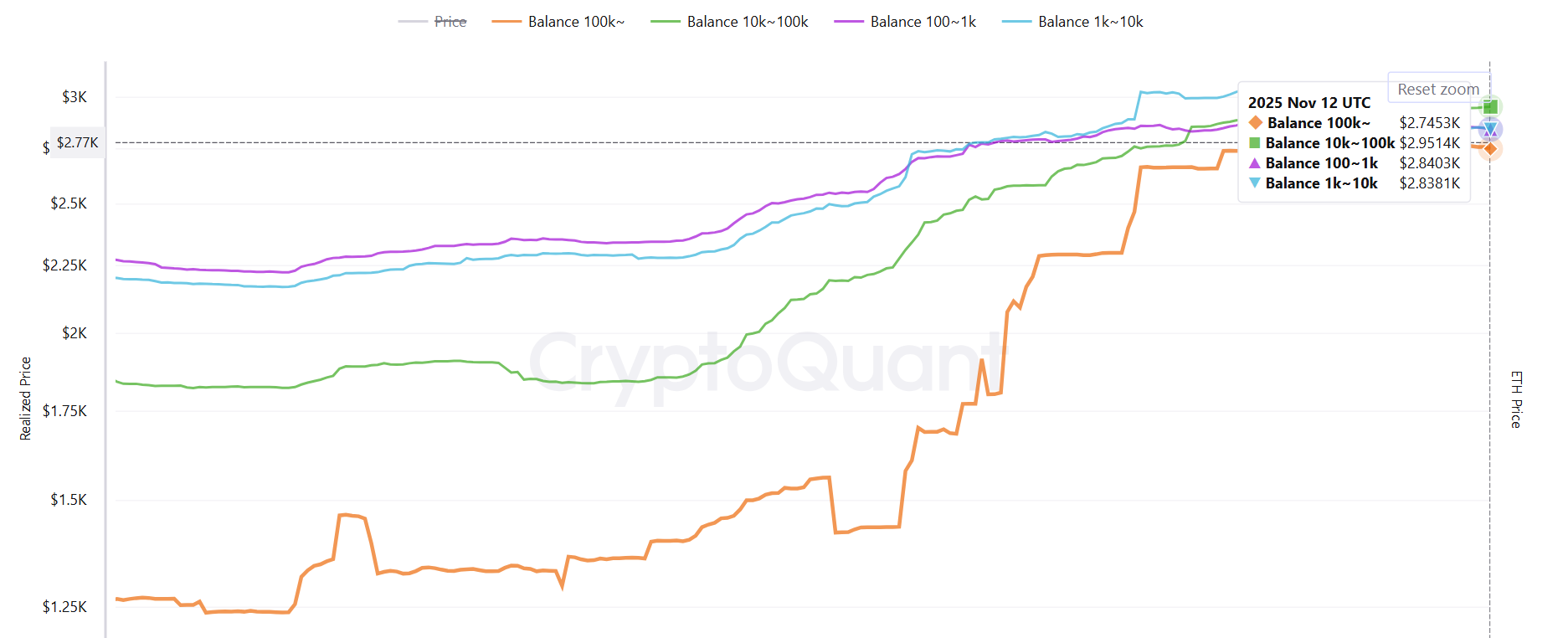

Ethereum (ETH) dived 7% on Thursday, sparking increased profit-taking and loss realization, as prices approached the cost basis of whales.

Increase in loss realization could spark a heavy decline in ETH

Ethereum investors continued their selling activity this week, with profit-taking and loss realization rising as prices remained subdued due to macroeconomic factors.

Investors have booked over $500 million in profits and $100 million in losses since Sunday, according to data from crypto analytics platform Santiment.

[22-1763069813663-1763069813664.28.11, 13 Nov, 2025].png)

During periods of sustained market declines, loss realization data is one of the main metrics investors watch. While loss taking remains moderate for now, an increase in the figure has historically triggered heavy distribution and a subsequent plunge in prices.

For example, ETH traded in the $3,200-$3,500 range in late January, when increased loss booking sent its price crashing by over 50% within the next three months. With macroeconomic pressures weighing on the market, it would be no surprise if a further price decline pushes investors to capitulate.

Prices are also approaching the average cost basis or realized price of whales with a balance of 10K-100K ETH, which is around $2,900. A decline below their cost basis has often sparked intense selling pressure as they look to cut losses.

It's important to note that these whales have been key in absorbing the selling pressure since ETH's price decline accelerated over the past month, increasing their collective balance by 890K ETH during the period. The decline could accelerate if their buying activity is lost.

Conversely, selling activity in the past two weeks has largely stemmed from retailers and coin holders within the 90-day-old bracket.

On the derivatives side, open interest (OI) remains subdued, failing to sustain a rise above 12 million ETH since the October 10 leverage flush, according to Coinglass data. Open interest is the total worth of outstanding contracts in a derivatives market.

In other news, a major Ethereum whale has been taking on leverage to accumulate the top altcoin, amassing about $1.3 billion worth of ETH since November 4.

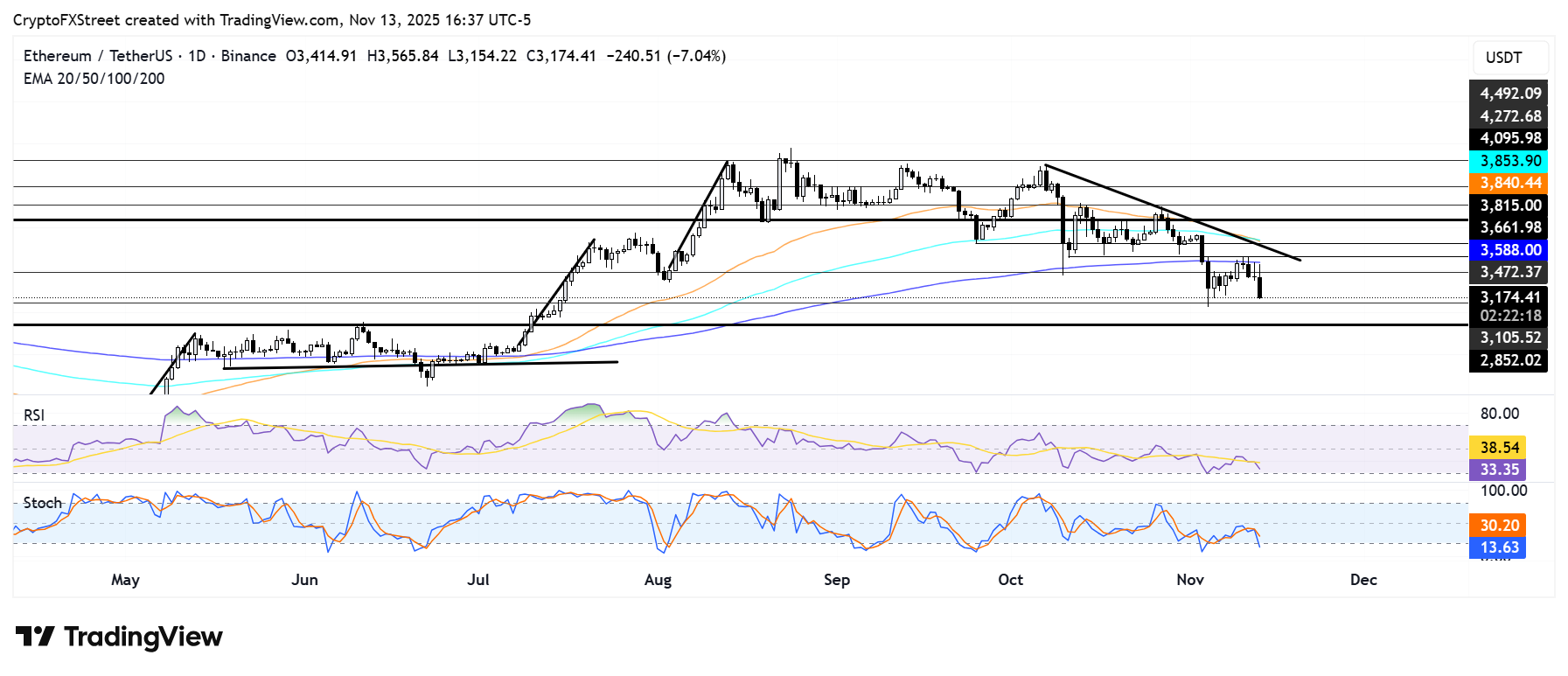

Ethereum Price Forecast: ETH falters before 200-day EMA again, eyes $3,100 support

Ethereum saw $206.5 million in futures liquidations over the past 24 hours, fronted by $155.3 million in long liquidations, per Coinglass data.

ETH is approaching the support near $3,100 after facing a second consecutive day of rejection at the 200-day Exponential Moving Average (EMA). The top altcoin could decline to the key support level at $2,850 if it fails to bounce off $3,100.

On the upside, ETH has to rise above the 200-day EMA to begin a recovery.

The Relative Strength Index (RSI) is in a downtrend below its neutral level, while the Stochastic Oscillator (Stoch) is on the verge of entering the oversold region.