Ethereum Price Forecast: ETH continues recovery as BitMine stash surpasses $11 billion

Ethereum price today: $4,180

- BitMine grows its holdings to 2.65 million ETH, continuing its accumulation of the top altcoin.

- The purchase comes after it raised over $365 million from an institutional investor last week.

- ETH faces another test at a key descending trendline after rising above $4,100.

Ethereum (ETH) continued its recovery on Monday, rising 4% following BitMine's latest update that it now holds over 2.65 million ETH.

BitMine continues Ethereum accumulation after 234,850 ETH purchase

Ethereum treasury company BitMine Immersion Technologies (BMNR) increased its holdings by 234,850 ETH last week, continuing its steady accumulation of the top altcoin.

As a result, the Nevada-based firm said it has grown its treasury to 2.65 million ETH — valued at about $10.8 billion — which is approximately 2.19% of the 121.09 million ETH circulating supply, per Ultrasound Money data.

In addition to its Ethereum stash, BitMine also holds 194 BTC, a $157 million stake in the Worldcoin (WLD) treasury, Eightco Holdings, and unencumbered cash of $436 million. This brings its total crypto and cash holdings to $11.6 billion.

"As we enter the final months of 2025, the two Supercycle investing narratives remain Al and crypto. And both require neutral public blockchains. Naturally, Ethereum remains the premier choice given its high reliability and 100% uptime. These two powerful macro cycles will play out over decades," said BitMine's Chairman and Fundstrat CIO Thomas Lee.

He highlighted that the company will continue its goal to accumulate 5% of ETH's circulating supply.

"Since ETH's price is a discount to the future, this bodes well for the token and is the reason BitMine's primary treasury asset is ETH [...] the power law benefits large holders of ETH, hence, we pursue the 'alchemy of 5%' of ETH," added Lee.

The company's latest purchase follows an update last week that it raised over $365 million by selling 5,217,715 shares of its common stock at $70 per share to an unnamed institutional investor.

BitMine, which began purchasing ETH in July, is the largest publicly traded Ethereum treasury in the world. The company's 2.65 million ETH stash is more than three times the size of its closest competitor, SharpLink Gaming (SBET), which holds about 838,700 ETH.

BMNR is trading around $53.80 and has seen a 6% gain at the time of publication on Monday.

Meanwhile, US spot Ethereum exchange-traded funds (ETFs) saw a negative performance, recording net outflows of $795 million last week, according to SoSoValue data.

Ethereum Price Forecast: ETH faces test of $4,100 and key descending trendline resistance

Ethereum experienced $126.1 million in futures liquidations over the past 24 hours, primarily driven by $106.7 million in liquidated short positions, per Coinglass data.

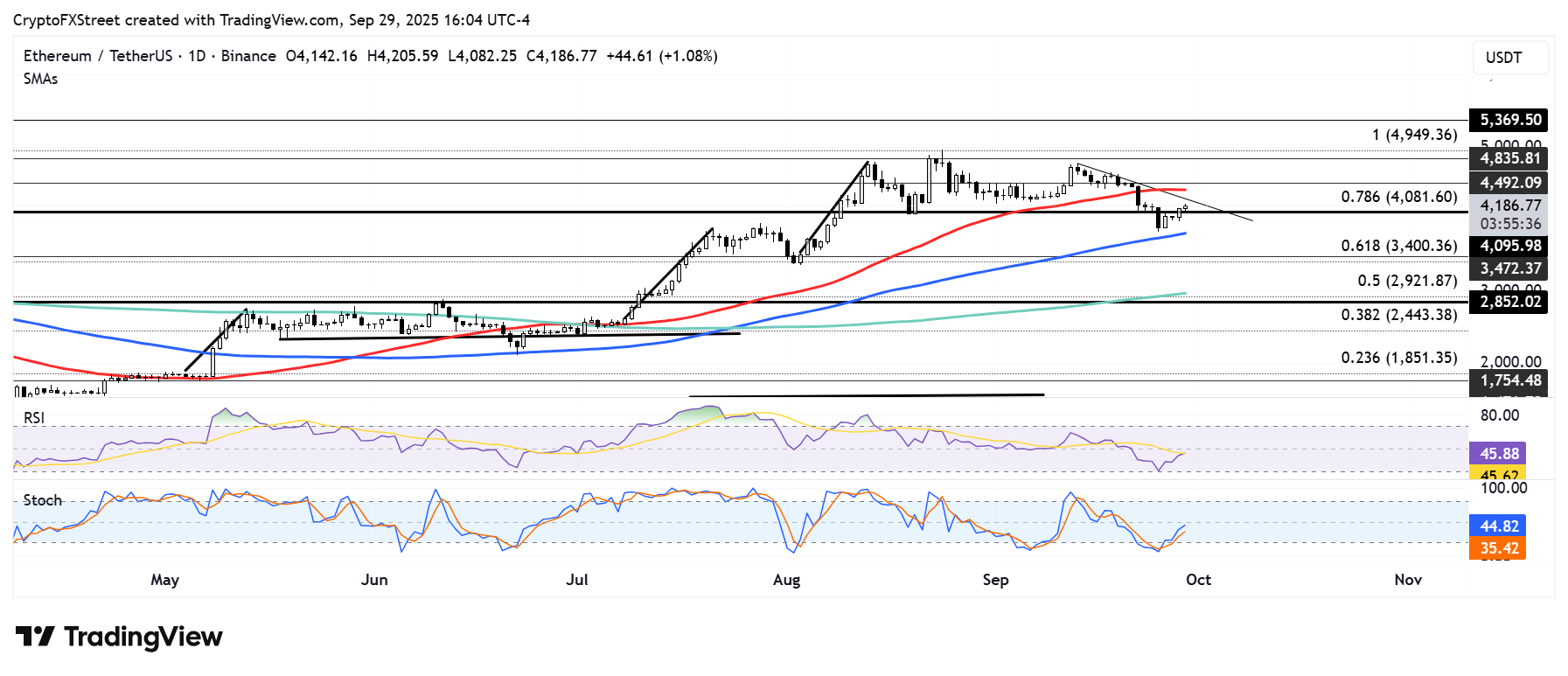

After finding support around $3,800 — just above the 100-day Simple Moving Average (SMA) — ETH recovered the $4,000 psychological level over the weekend.

ETH/USDT daily chart

However, the top altcoin is facing pressure after rising past $4,100 — a level that stood as a critical resistance throughout 2024. Above $4,100 is a descending trendline hurdle extending from September 13. ETH must rise above these barriers to test the $4,500 key level, which is strengthened by the 50-day SMA just below it.

On the downside, ETH could find support around $3,500 if it fails to hold the 100-day SMA support around $3,800.

The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) have recovered from oversold conditions and are trending upward, indicating a declining bearish momentum. A firm move above their neutral levels could boost bullish pressure.