Crypto Today: Bitcoin bulls eye $116,000 as Ethereum and XRP steady

- Bitcoin holds $112,000 after weekend recovery as bulls push to regain control.

- Ethereum’s uptrend above $4,000 could face resistance at the 50-day EMA.

- XRP eyes breakout above $3.00, backed by a bullish RSI and the 100-day EMA support.

Bitcoin (BTC) extends gains to trade above $112,000 on Monday, as bulls push to regain control, following last week’s persistent drawdown. Altcoins, including Ethereum (ETH) and Ripple (XRP), are offering subtle bullish signals that could shape the trend this week.

Data spotlight: Retail demand boosts Bitcoin's bullish outlook

Bitcoin has recovered from last week’s decline to $108,630, reflecting an improvement in risk-on sentiment in the broader cryptocurrency market. This comes after extremely oversold markets, which are likely to have encouraged buy-the-dip orders, as investors positioned themselves for this week’s trading.

CoinGlass data shows that retail interest began improving on Sunday, with the futures Open Interest (OI) rising to $79.17 billion by the time of writing on Monday from $77.72 billion.

OI tracks the notional value of outstanding futures contracts; hence, a consistent rebound suggests that traders are gaining confidence in the market. It also means that sentiment is improving, as liquidations force traders to close their short positions, in favour of long positions targeting a move to $116,000.

Bitcoin Futures Open Interest | Source: CoinGlass

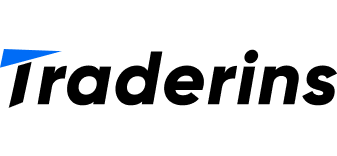

Ethereum is experiencing extreme volatility, with retail demand fluctuating. According to CoinGlass data, the OI-Weighted Funding Rate averages at 0.0033% on Monday after sliding to -0.0001% on Sunday. On Saturday, this metric surged, reaching 0.0083%, highlighting the extremely volatile trading environment.

A steady OI-weighted funding rate implies that traders are increasingly piling into long positions, providing the bullish momentum required to sustain the uptrend.

Ethereum OI-Weighted Funding Rate | Source: CoinGlass

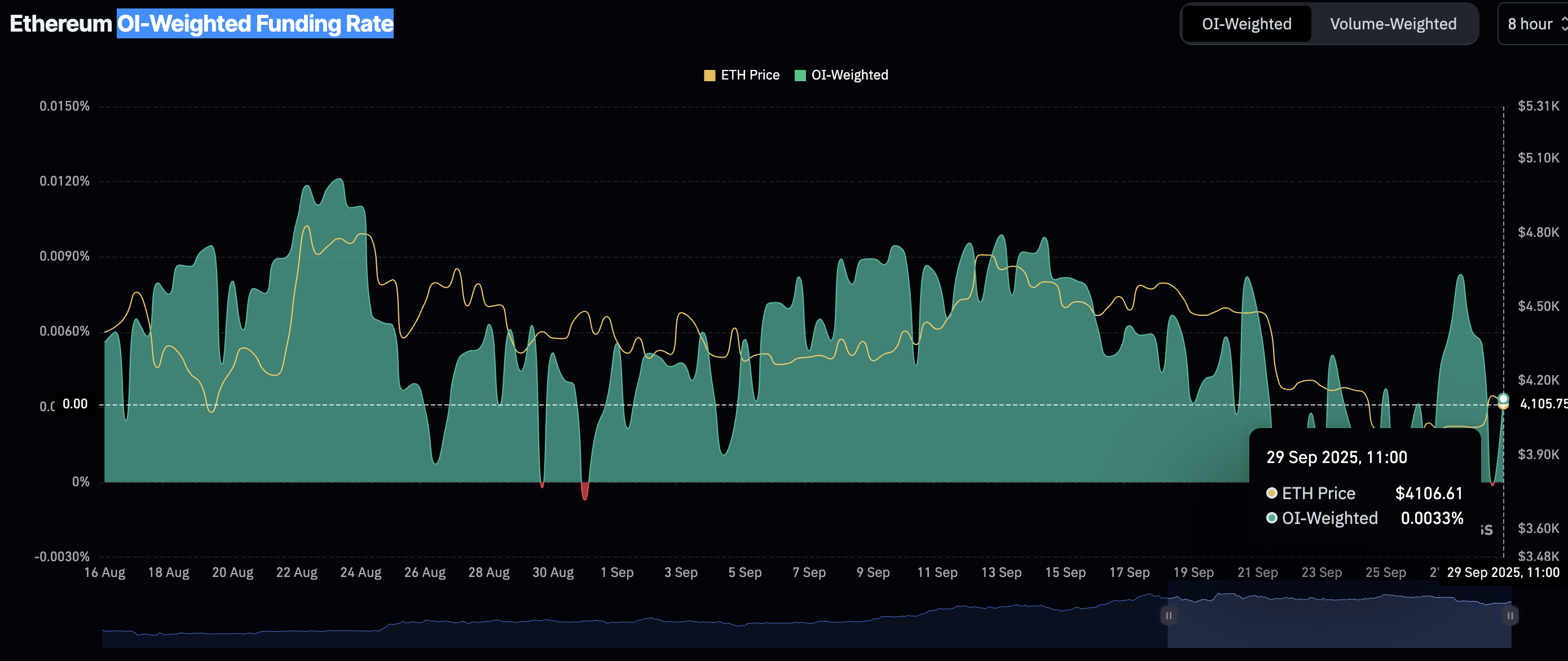

Retail interest in XRP has stabilized at significantly lower levels compared to levels seen in July, when the cross-border money remittance token reached a new record high of $3.66.

According to CoinGlass data, the futures OI averaged $7.56 billion on Monday, which is slightly above the $7.35 billion recorded on Saturday, but significantly below July’s peak level of $10.94 billion. If the OI rises steadily this week, indicating a surge in retail demand for XRP, the ongoing recovery could steady above the critical $3.00 level.

XRP Futures Open Interest | Source: CoinGlass

Chart of the day: Can Bitcoin sustain gains this week?

Bitcoin holds above the 100-day Exponential Moving Average (EMA) currently at $111,758 at the time of writing on Monday. Bulls have shown their intent since Sunday in regaining control of the trend, evidenced by the Relative Strength Index (RSI) rising to 47 on the daily chart, following a correction to 36 on Thursday.

Traders will be looking for a daily close above the 100-day EMA to assess bullish strength. The 50-day EMA at $113,252 holds as the next resistance, but bulls may need to break above the descending channel on the same chart to validate a clear breakout toward the $116,000 round-number resistance.

Still, a sell signal maintained by the Moving Average Convergence Divergence (MACD) indicator on Tuesday indicates that Bitcoin is not yet out of the woods. If selling pressure persists as investors reduce exposure, another drop below the $110,000 level could be on the cards.

BTC/USDT daily chart

Altcoins update: Ethereum, XRP show subtle recovery signals

Ethereum has recovered above $4,100 after last week’s sharp correction to $3,811. This upward move was primarily driven by a surge in retail interest, with the funding rate rising, as highlighted above.

From near oversold conditions on Thursday, the RSI is currently stabilizing at 43 on the daily chart, hinting at an increase in buying pressure. Higher RSI readings mean improving bullish momentum.

Still, a bearish MACD indicator suggests that the bulls are struggling to maintain the price of ETH at elevated levels. Investors could continue reducing exposure if the blue line holds below the red signal line.

Key areas of interest for traders are the 50-day EMA at $4,209, a resistance that must be broken to validate a medium-term uptrend toward the record high of $4,956 and the 100-day EMA, which provides support at $3,864.

ETH/USDT daily chart

As for XRP, bulls are delicately holding onto support at $2.83, provided by the 100-day EMA, after facing rejection at the 50-day EMA positioned at $2.92. Investors would anticipate another breakout attempt from the short-term support, but the struggling RSI’s uptrend at 46 on the daily chart could challenge the bullish outlook, leaving XRP vulnerable to further losses.

XRP/USDT daily chart

Key areas of interest for traders are the demand level at $2.70, which was previously tested on Monday, and the 200-day EMA at $2.61. On the other hand, a successful break above the 50-day EMA at $2.92 would back the trend reversal. Still, risks could remain tilted downward until the XRP price breaks the overall downtrend marked by a descending trendline since late July.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.