XRP gains 8% as Ripple partners with SBI to boost RLUSD adoption Japan

- Ripple revealed a partnership with SBI Holdings to begin distributing its RLUSD stablecoin in Japan.

- Fed Chair Powell delivered dovish remarks at Jackson Hole, hinting at the possibility of rate cuts.

- XRP breaks above the 50-day SMA as it tests a key symmetrical triangle lower boundary.

XRP gained 8% on Friday after Ripple announced a partnership with Japanese firm SBI Holdings to begin distributing the Ripple USD (RLUSD) stablecoin in Japan. The remittance-based token's rise was also partly fueled by dovish hints from Federal Reserve (Fed) Chair Jerome Powell in his speech at the Jackson Hole Economic Symposium.

XRP rallies following Ripple's partnership to spread RLUSD across Japan and dovish Fed remarks

Payment company Ripple signed a Memorandum of Understanding (MoU) to bring RLUSD to the Japanese market, according to a statement on Friday.

The rollout is slated for Q1 2026 via licensed distributor SBI VC, a crypto-focused subsidiary of SBI Holdings.

"Our partnership with SBI has always been about more than just technology; it's about building a trusted and compliant financial future," said Jack McDonald, Ripple's Senior Vice President of Stablecoins.

SBI claims to be the first company in Japan to secure an Electronic Payment Instrument Exchange Service Provider license and has already begun offering stablecoin services.

"The introduction of RLUSD will not just expand the option of stablecoins in the Japanese market, but is a major step forward in the reliability and convenience of stablecoins in the Japanese market," said SBI VC Trade CEO Tomohiko Kondo.

RLUSD is a US-dollar-dominated stablecoin that runs on the XRP Ledger (XRPL) and Ethereum blockchain.

Meanwhile, XRP is up 8% over the past 24 hours. The rise follows a broader uptick in the crypto market after Fed Chair Powell's speech at Jackson Hole on Friday hinted at a potential rate cut in the agency's next policy makers meeting in September.

Powell noted that weakness in the labor market could push the agency to consider a shift in policy stance.

XRP tests symmetrical triangle trendline, eyes $3.39 level

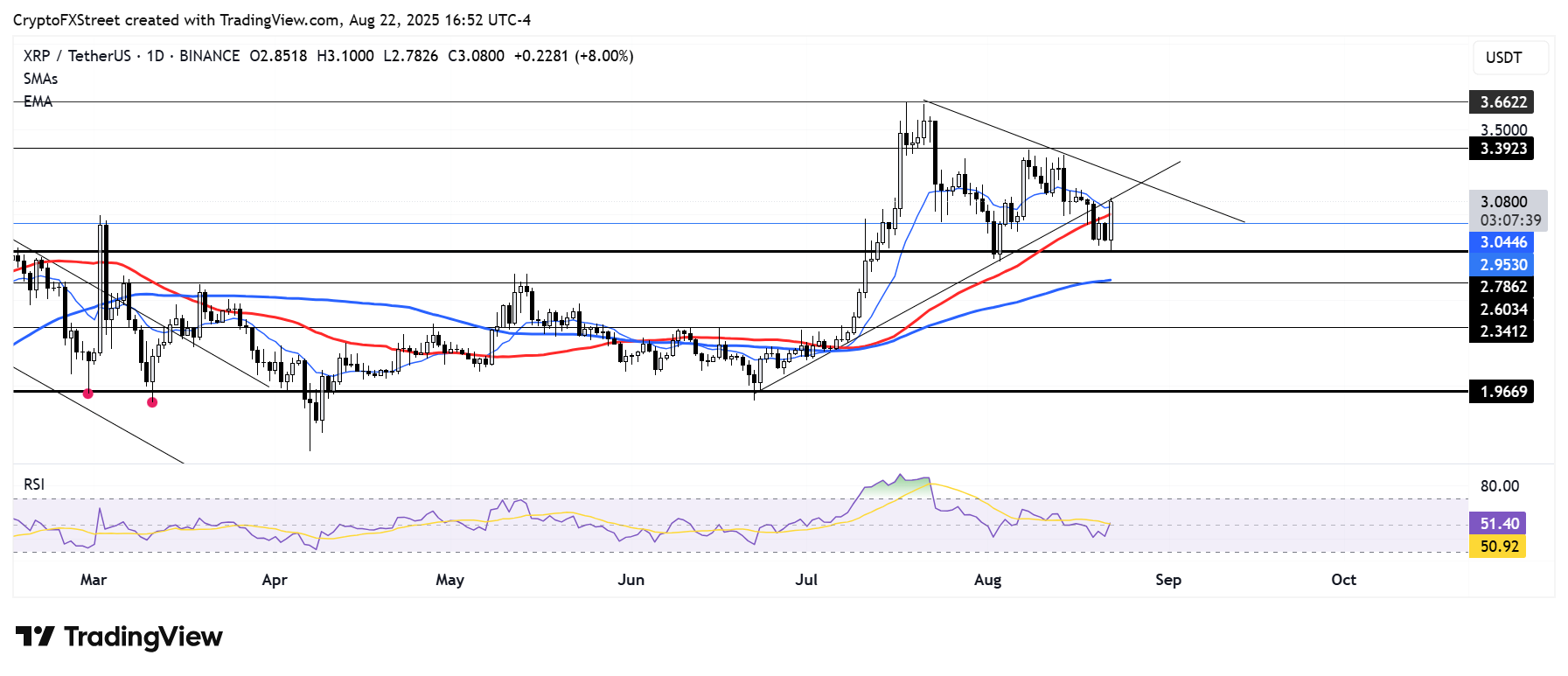

XRP is testing the lower boundary line of a symmetrical triangle after breaking above the 50-day Simple Moving Average (SMA) and 14-day Exponential Moving Average (EMA).

XRP/USDT daily chart

A firm move above the upper boundary of the triangle could push XRP toward the $3.39 resistance. The remittance-based token could test its all-time high resistance if it sustains a firm close above $3.39.

The Relative Strength Index (RSI) is on the verge of crossing its neutral level and moving average line, indicating a potential shift toward bullish leaning.

A firm close below $2.78 will invalidate the bullish thesis and potentially send XRP to the support level at $2.60, which is strengthened by the 100-day SMA.