Bitcoin Price Forecast: BTC recovers above $114,000 despite heavy ETF outflows, rising uncertainty

- Bitcoin price recovers slightly, trading above $114,000 on Monday, after falling nearly 5% the previous week.

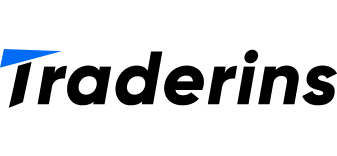

- US-listed ETFs recorded an outflow of $643 million last week, the largest since mid-April.

- US SEC Chair Atkins' policy update failed to ignite bullish momentum in the market.

Bitcoin (BTC) price recovers slightly, trading above $114,000 at the time of writing on Monday, after correcting nearly 5% the previous week. Despite the rebound, market sentiment remains fragile as spot Bitcoin Exchange Traded Funds (ETFs) record the largest outflows since mid-April, and growing macroeconomic uncertainty continues to weigh on investor confidence.

The latest policy update from US Securities and Exchange Commission (SEC) Chair Paul Atkins offered little immediate support to crypto prices, suggesting that regulatory clarity alone may not be enough to reignite bullish momentum in the near term.

Bitcoin spot ETFs record the largest outflow since mid-April

Bitcoin spot ETFs data shows early signs of weakness. According to the SoSoValue data, US spot Bitcoin ETFs recorded an outflow of $643.04 million last week, breaking a seven-week streak of inflows since mid-June and the highest weekly outflow since mid-April. If these outflows continue, BTC could see further correction.

Total Bitcoin Spot ETF Net inflow weekly chart. Source: SoSovalue,

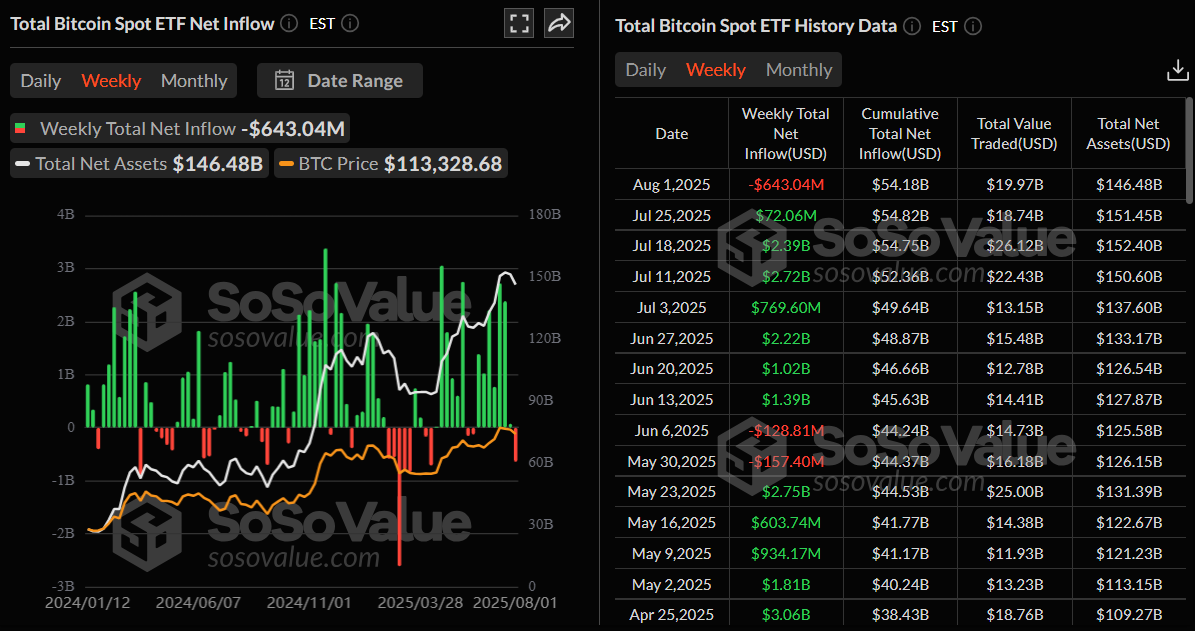

Despite the decline in institutional interest last week, some corporations have continued to announce Bitcoin purchases.

Japanese investment company Metaplant announced on Monday that the firm has acquired an additional 463 BTC, bringing the total holding to 17,595 BTC. If more corporate companies, such as Strategy and others, accumulate BTC, their holdings could serve as a cushion against further price declines by reinforcing long-term investor confidence.

Trade uncertainty and the Fed rate decision trigger risk-off sentiment

Bitcoin's recent correction follows the mid-week US Federal Reserve (Fed) interest rate decision, where rates were held steady at 4.25%–4.50%, and the lack of clarity on a potential September rate cut reinforced a hawkish stance, triggering risk-off sentiment that weighed heavily on risk assets like Bitcoin.

US President Donald Trump's new tariffs on multiple countries last week sparked market uncertainty, which in turn fueled a rise in risk aversion. This led to a decline in the US equities market and riskier assets, such as Bitcoin.

NYDIG reported last week that crypto received a boost from the White House’s supportive report on digital assets and US Securities and Exchange Commission (SEC) Chair Atkins recent speech, which outlined numerous changes that should benefit the industry.

“They didn’t prove to be catalysts to keep the market rally going,” says analyst Greg Cipolaro.

Cipolaro added that markets will now have to contend with the summer seasonal lull in August, while expectations for rate cuts continue to be pushed out and jobs numbers come in weak.

In an exclusive interview, Marcin Kazmierczak, Co-founder of RedStone, told FXStreet that Bitcoin's recent correction was driven by the reciprocal tariffs of between 10%-39% imposed by the US on countries like Taiwan and Vietnam.

Still, BTC is showing relative strength, falling only 2.3% while crypto-related stocks dropped 16% and altcoins fell 5-6% and. technical support held at the $113,000 level (50-day EMA), he said.

"The correction appears to be a healthy consolidation after July’s strong rally to $122,000, and Bitcoin’s role as a non-sovereign store of value may strengthen if tariffs weaken the US Dollar," Kazmierczak added.

Bitcoin Price Forecast: BTC recovers after retesting key support zone

The weekly chart shows that BTC failed to close above the $120,000 psychological level and declined nearly 5% last week, retesting its previous all-time high of $111,980. At the start of this week on Monday, it recovered somewhat and it is trading slightly above $114,000.

If BTC continues to find support around the $111,980 level, it could extend the recovery toward its psychological level of $120,000.

The Relative Strength Index (RSI) on the weekly chart reads 62, well above its neutral level of 50, indicating the bulls are still in control of the momentum. Additionally, the Moving Average Convergence Divergence (MACD) indicator continues to show a bullish crossover, giving further credence to the upward trend.

BTC/USDT weekly chart

Looking at the daily chart, BTC broke below its lower consolidation level at $116,000 on Thursday and declined nearly 3% in the next two days, retesting its 50-day Exponential Moving Average at around $112,974. This 50-day EMA roughly coincides with the previous all-time high of $111,980, making it a key support zone.

BTC recovered 1.48% after retesting this support zone on Sunday. If this area continues to hold, BTC could extend the recovery towards its previously broken lower consolidation level at $116,000.

The RSI on the daily chart reads 46 and points upward toward its neutral level of 50, indicating lack of momentum. For the recovery rally, the RSI should move above its neutral level.

BTC/USDT daily chart

If BTC correction resumes, it could extend the decline toward its key support level at $112,975, its 50-day EMA.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.