Bitcoin Price Forecast: BTC recovers as Iran-Israel ceasefire fuels risk-on sentiment

- Bitcoin price stabilizes around $105,000 on Tuesday after a 4.33% gain on Monday, driven by easing geopolitical and regulatory concerns.

- Global risk appetite is increasing as the ceasefire between Iran and Israel, along with the Fed's softer stance on crypto-related banking, takes hold.

- Institutional demand remains robust as Strategy and MetaPlanet add BTC while spot ETFs record $350.43 million in inflows.

Bitcoin (BTC) price is stabilizing around $105,000 at the time of writing on Tuesday, following a 4.3% recovery the previous day. The rebound comes as global risk sentiment improves following a ceasefire between Iran and Israel, and as the US Federal Reserve (Fed) announced a softer stance on crypto-related banking on Monday. Apart from this risk-on sentiment, institutional demand remained strong as corporations accumulated BTC in their reserves and fresh Exchange Traded Fund (ETF) inflows, suggesting a further recovery in BTC prices.

Risk-on sentiment rises as easing geopolitical tensions

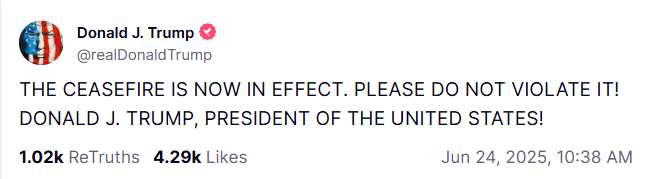

Bitcoin price recovered sharply on Monday, closing the day with a 4.3% gain, as news emerged that Donald Trump had announced a “complete and total” ceasefire between Israel and Iran, effectively pausing the ongoing 12-day war.

Later on Tuesday, Donald Trump’s Truth Social account posted that “THE CEASEFIRE IS NOW IN EFFECT,” and called on both nations not to violate it, fueling the risk-on sentiment in the global markets.

Gains in crypto markets were also supported by improved risk appetite and rising expectations of a dovish Federal Reserve (Fed), which have pushed the 2-year Treasury yield further below the 4% mark.

Traders now await the US economic docket, featuring the release of the Conference Board's Consumer Confidence Index. This, along with speeches by Fed officials, will drive the US Dollar and overall market sentiment.

The main focus is on Fed Chair Jerome Powell's testimony before the House Financial Services Committee at 14:00 GMT , which could offer hints about the future rate-cut path and influence risky assets such as Bitcoin.

Supporting regulatory policies boosts BTC price

The US Federal Reserve Board announced on Monday that “reputational risk” will no longer be a component of its examination programs in supervising banks.

This news added fuel to the ongoing recovery of Bitcoin, as the “reputational risk,” also commonly known as Operation Choke Point 2.0, had previously prevented banks from providing custody services for crypto assets and financial services to digital asset companies.

This policy shift and the Fed's more lenient stance on crypto-related banking could boost the wider adoption and acceptance of digital assets. However, the Fed still expects banks to maintain robust risk management to ensure safety and soundness, as well as compliance with laws and regulations.

Senator Cynthia Lummis says on her X account, “This is a win, but there is still more work to be done.”

Bitcoin’s institutional demand remains robust

Bitcoin institutional demand starts the week on a positive note. Strategy, previously known as MicroStrategy, announced on Monday that it has added 245 BTC to its holdings. The firm currently holds 592,345 BTC.

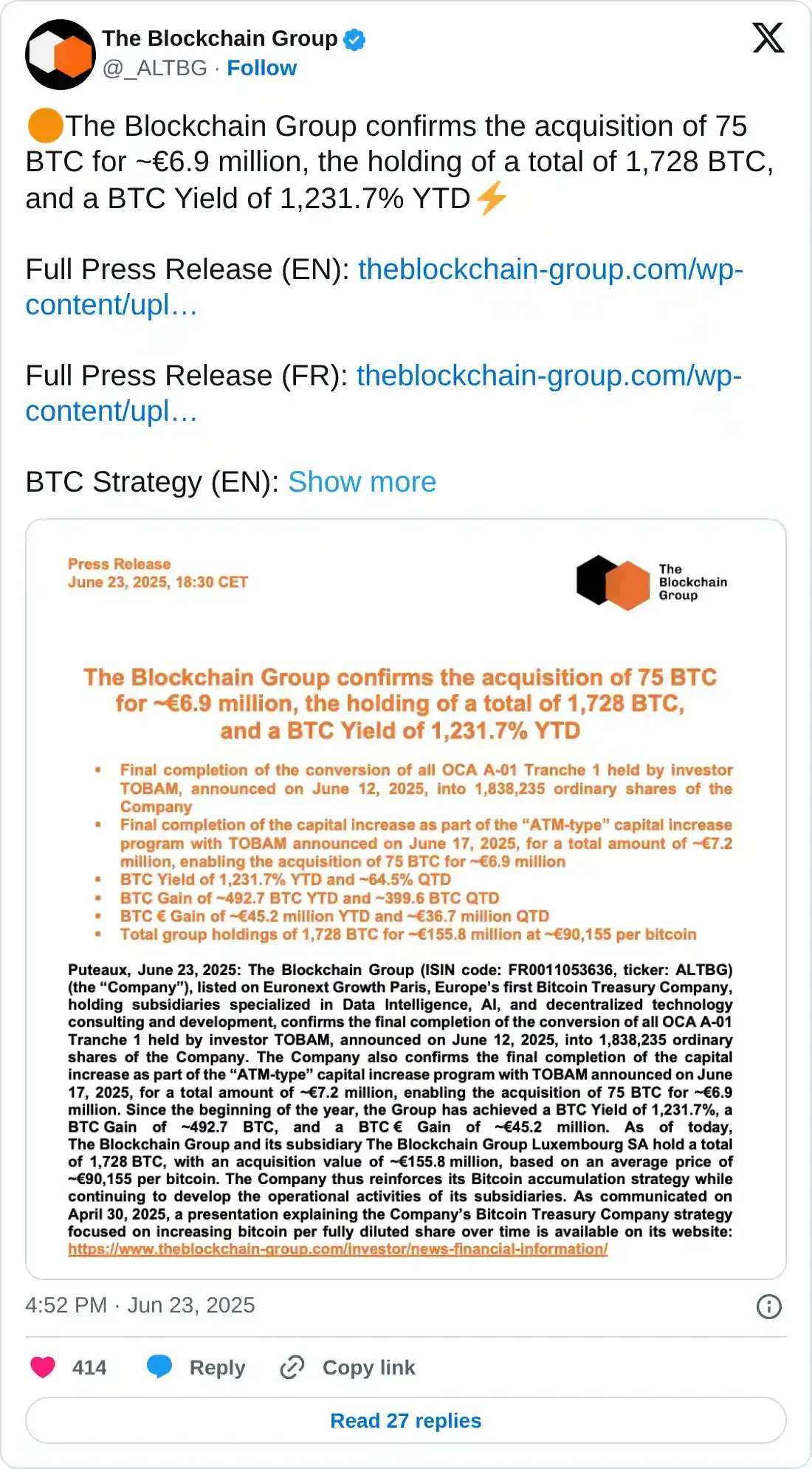

Japanese investment firm Metaplanet also purchased an additional 1,111 BTC, bringing the total holding to 11,111 BTC. Following the footsteps of the Strategy and Metaplanet, the Blockchain Group confirms the acquisition of 75 BTC, bringing its total holding to 1,728 BTC.

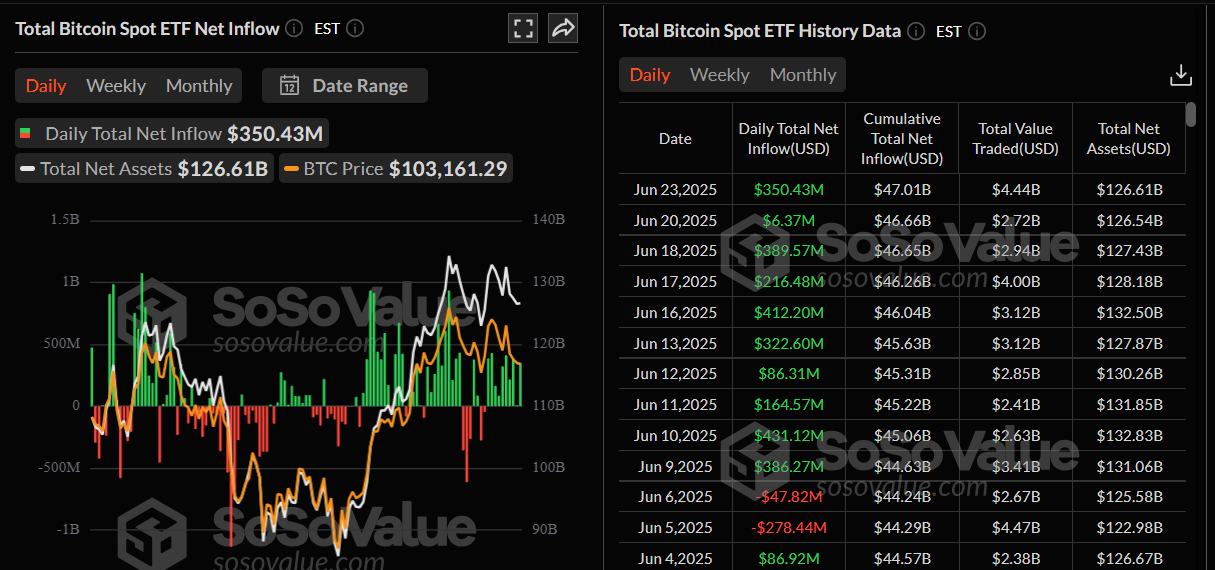

According to SoSoValue data, US spot Bitcoin ETFs recorded an inflow of $350.43 million on Monday, continuing its 10-day streak of gains since June 9.

Total Bitcoin Sport ETF net inflow daily chart. Source: SoSoValue

Bitcoin Price Forecast: BTC closes above 50-day EMA

Bitcoin price reached a low of $98,200 on Sunday and recovered sharply by 4.3% on Monday, surpassing the 50-day EMA and closing above $105,300. At the time of writing on Tuesday, it hovers at around $105,200.

If BTC continues its recovery, it could extend the rally toward its May 22 all-time high at $111,980.

The Relative Strength Index (RSI) on the daily chart hovers around its neutral level of 50, indicating fading bullish momentum. For the bullish momentum to be sustained, the RSI should continue to move above its neutral level. The Moving Average Convergence Divergence (MACD) is hinting at a bullish crossover (the MACD line is close to crossing above the signal line), which, if completed, would give a buy signal.

BTC/USDT daily chart

However, if BTC faces a correction and closes below the 50-day EMA at $103,188, it could extend the decline to retest its Sunday low of $98,200.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.