Crypto Today: Bitcoin, XRP shrug off Japan's SBI Holdings ETF filing, Ethereum holds steady

- Bitcoin struggles to regain its footing on Wednesday, trading around $114,000.

- Japan's financial giant SBI Holdings files for Bitcoin and XRP ETFs with the FSA, underpinning institutional demand.

- Ethereum holds above $3,600 support as spot ETFs record $73 million in inflows on Tuesday.

Cryptocurrency markets are showing mixed signals on Wednesday, with select altcoins sustaining recovery following last week's sell-off. Bitcoin (BTC) remains on the back foot, trading around $114,000 after a knee-jerk swing from its intraday low of $113,355.

Ethereum (ETH) is among the altcoins offering bullish signals, holding above $3,600, supported by rising institutional demand. Ripple (XRP), on the other hand, has extended the decline below support-turned-resistance at $3.00, reflecting the shaky sentiment in the broader cryptocurrency market.

Market overview: Japan's SBI Holdings files for Bitcoin, XRP ETFs

SBI Holdings, one of Japan's financial giants, has filed for two Exchange Traded Funds (ETFs) targeting Bitcoin and XRP with the Financial Services Agency (FSA). According to a report by AInvest, the proposed products include a "Crypto-Asset ETF" and a "Digital Gold Crypto ETF," aiming to provide exposure to digital assets by blending Traditional Finance (TradFi) and emerging financial vehicles.

The "Crypto-Asset ETF" will mainly provide access to Bitcoin and XRP, with the "Digital Gold Crypto ETF" allocating over 50% of its assets to Gold and the rest to digital assets.

SBI Japan, a subsidiary of SBI Holdings, has been Ripple's long-term strategic partner, providing cross-border payments in key financial corridors by tapping flagship products such as On-Demand Liquidity (ODL) and Ripple Payments.

If approved, this would mark SBI's major leap into providing investors access to digital assets. The initiative aligns with the institution's broader strategy to integrate blockchain and digital assets into its financial services.

The FSA has historically taken a cautious approach to regulating cryptocurrencies, leaning toward strict oversight to manage risk and protect customers. However, there has been a noticeable increase in interest from institutions seeking to offer digital asset investment products, suggesting a slow but strategic shift toward wider crypto adoption and innovation.

Despite the news, Bitcoin and XRP prices remained unfazed by the ETF application, dragged by the sticky risk-off sentiment amid concerns about macroeconomic uncertainty and higher tariffs in the United States (US).

Data spotlight: Ethereum posts ETF inflows

Ethereum spot ETFs saw around $73 million in inflows on Tuesday, suggesting that speculative demand is gradually recovering following its largest outflow in history, of around $465 million, recorded on Monday. If risk-on sentiment steadies in the upcoming days, a potential surge in demand could propel the price of ETH toward the $4,000 mark.

Ethereum spot ETF data | Source: SoSoValue

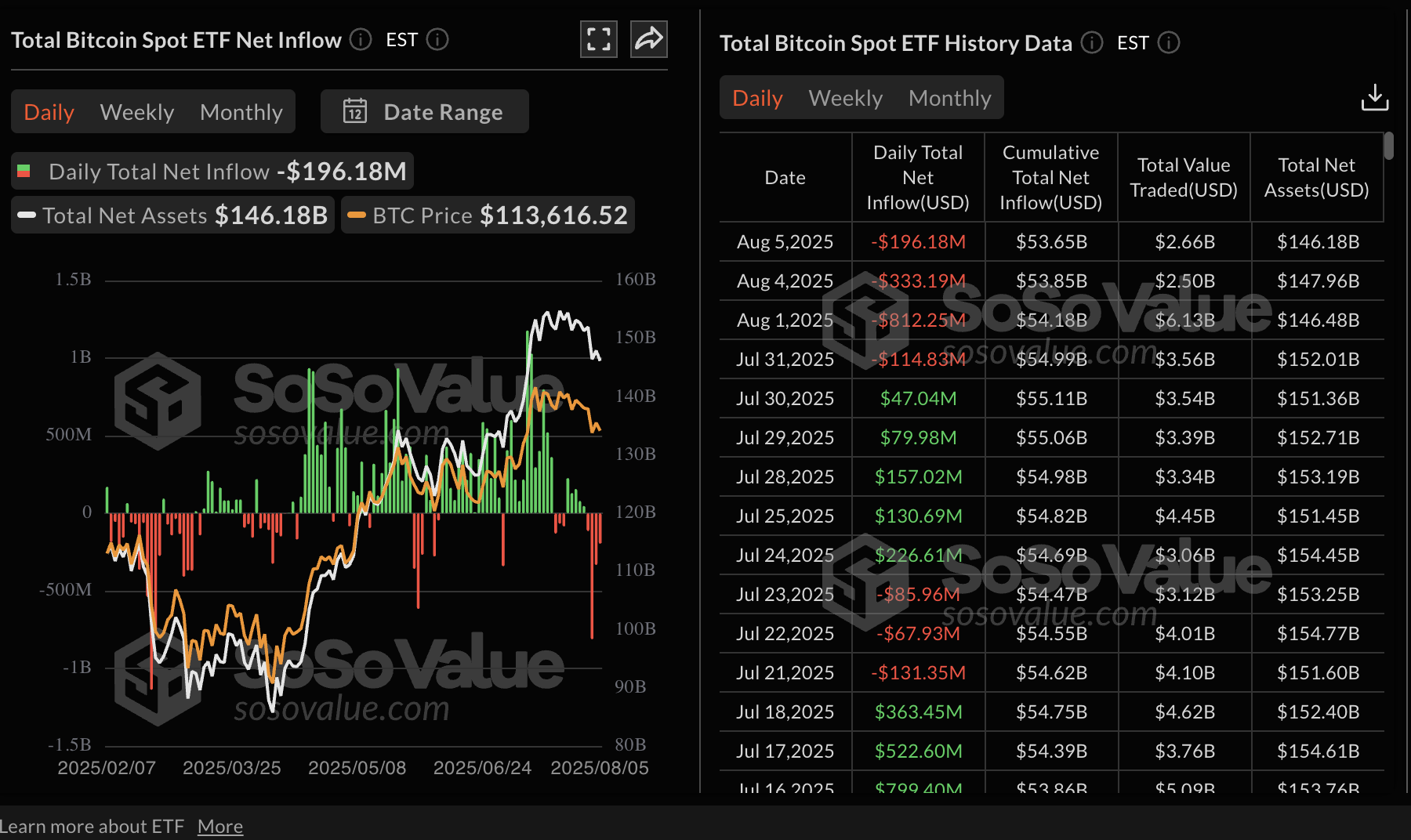

Interest in Bitcoin remains subdued, with the price currently hovering in the range of $112,000 to $116,000. According to SoSoValue data, spot ETFs extended the bearish streak, with outflows of $196 million on Tuesday, marking the fourth consecutive day in the red.

None of the ETFs operating in the US saw net inflows, with Fidelity's FBTC leading with outflows of $99 million, followed by BlackRock's IBIT with around $77 million and Grayscales' GBTC with approximately $20 million in outflows.

Bitcoin spot ETF data | Source: SoSoValue

Chart of the day: Bitcoin risks extending decline

Bitcoin price is extending its lower high pattern from the record high of $123,218 reached on July 14. Several attempts to sustain a recovery have been futile, capping price movement below resistance at $116,000.

A sell signal triggered by the Moving Average Convergence Divergence (MACD) indicator on July 23 reinforces the bearish outlook. The downtrend in BTC price is likely to extend toward the previous all-time high of around $112,000 if investors maintain the bearish bias and reduce exposure.

BTC/USDT daily chart

The 50-day Exponential Moving Average (EMA) at $113,073 provides immediate support to Bitcoin, but if the decline accelerates, traders will need to watch for lower anchors at $112,000 and the 100-day EMA at $108,245.

Altcoins update: Ethereum offers bullish signals, XRP falters

Ethereum bulls are working to uphold support above $3,600 while aiming for a breakout toward the $4,000 mark. This bullish outlook has been bolstered by a buy signal from the MACD indicator, which was triggered on Sunday on the 4-hour chart.

The SuperTrend has also provided a buy signal in the same time frame, after the price of ETH flipped above the trend-following tool. If traders increase exposure reflecting the short-term bullish outlook, the path of least resistance would remain upward, increasing the chances of Ethereum rising to tag the $4,000 level.

Still, traders should be aware of the immediate support provided by the 50-period EMA at $3,620, the 100-period EMA at $3,578 and the buyer congestion tested at $3,500 on Tuesday in case the decline persists.

ETH/USDT 4-hour chart

As for XRP, last week's downtrend has resumed below the support-turned-resistance at $3.00, underpinned by multiple sell signals from the MACD and the SuperTrend indicators.

XRP/USDT daily chart

Suppose speculative demand continues to fade as risk-off sentiment dominates. In that case, the path of least resistance will maintain downward, aiming for the 50-day EMA at $2.80, the 100-day EMA at $2.60 and the 200-day EMA at $2.35.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.